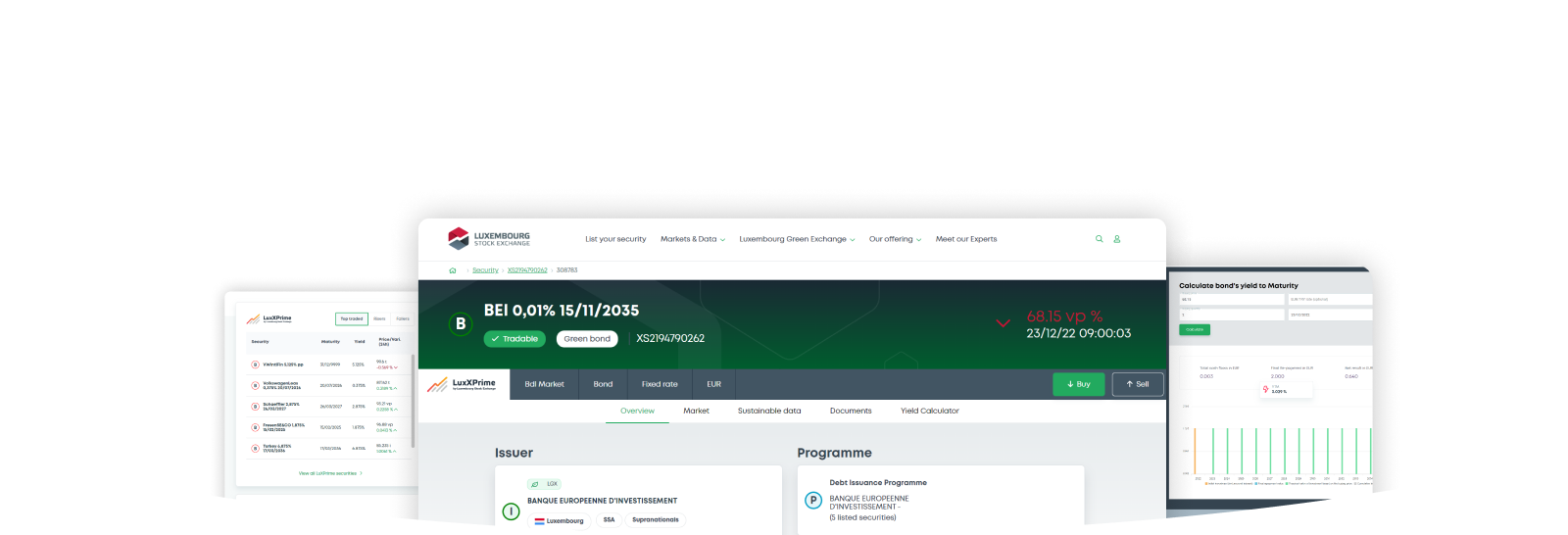

LuxXPrime

Unlock the potential of retail-sized bond trading

Launched together with our Prime Liquidity Provider EUWAX AG in 2019, LuxXPrime has quickly ascended in the bond trading universe. Today, LuxXPrime offers continuous prices presence and tight spreads in a distinct selection of over 2,000 tradable instruments, including more than 300 sustainable bonds and over 800 sovereign, sub-sovereign, and agency bonds.

LuxXPrime at a glance

2019

LuxXPrime goes live with 260 securities quoted by EUWAX AG

Explore LuxXPrime's journey and evolution

2020

2022

2023

2024

2025

Why choose

Firm prices & competitive spreads

Prime Liquidity Providers, show firm and competitive bid/ask prices for investors and orders are executed at published price.

Liquid bonds

Guaranteed presence of at least 80% by our Prime Liquidity Providers in the order book.

Low trading fees

All authorised LuxSE trading members have access to LuxXPrime and can unlock the potential of retail-sized bond trading at no extra cost.

Retail-sized minimum quantity

A minimum bid and ask size for retail-sized tickets is always available with institutional investors able to find firm prices from EUR 1,000 up to EUR 100,000.

Calculate a bond’s yield to maturity (YTM)

On the security card of bonds included in LuxXPrime’s selection, you will find a Yield Calculator to help you inform your retail-sized trading decisions.

Get real-time data and statistics

LuxXPrime brings quality market data straight to your screen in real-time and gives you the necessary insights into the bond market as it evolves. Find data and statistics on LuxSE’s historical bond trades and monthly or annual performance statistics to build a better bond trading strategy.

Useful links

Trading

Opening hours and closing days

LuxTrader

Our Trading Members